Brief

Reverse Mortgage Calculator

My Contribution

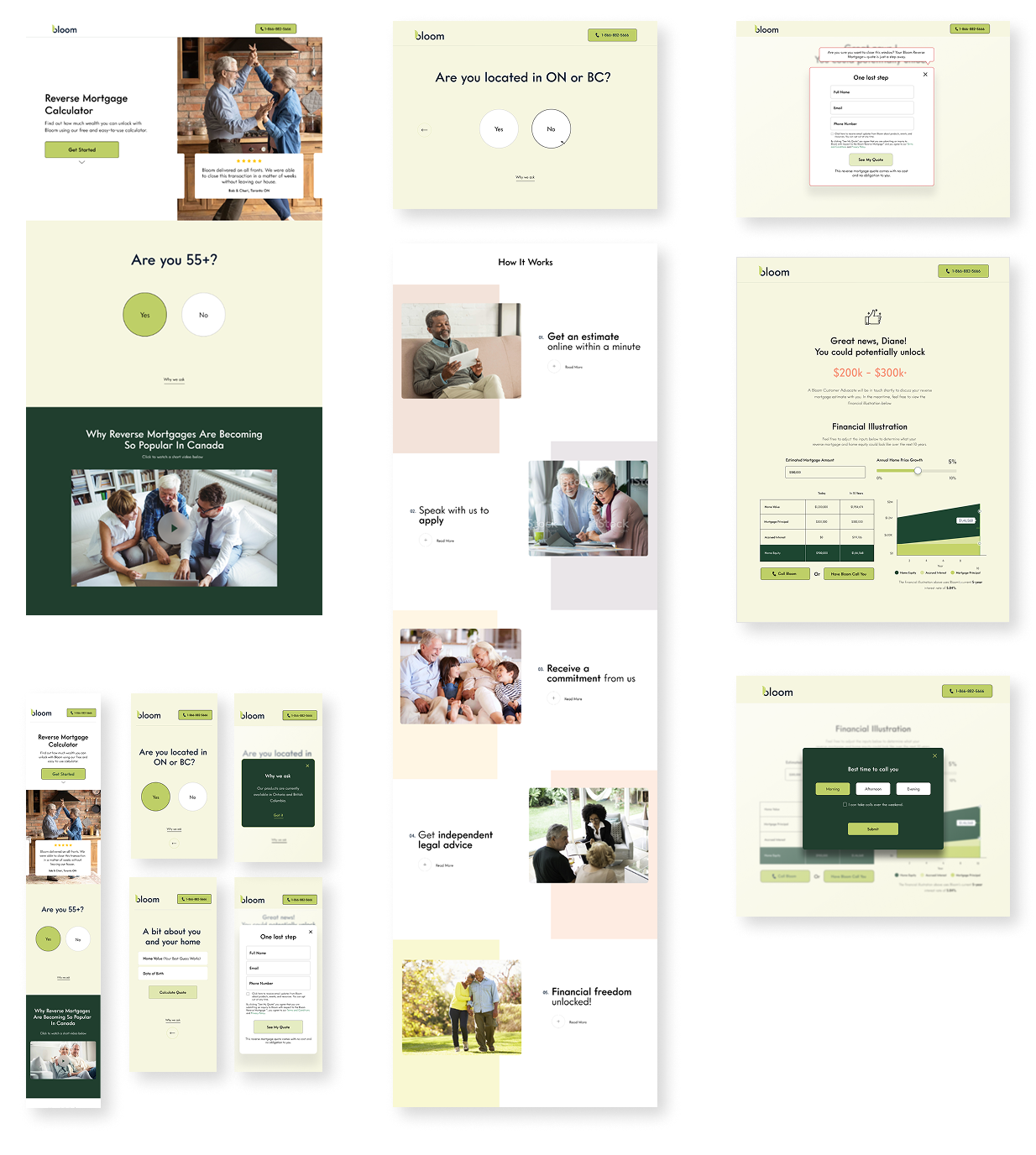

Designed and built Reverse Mortgage Calculator with Bloom's customer persona.

What is Reverse Mortgage Calculator?

A reverse mortgage is a special type of loan that allows homeowners aged 55 and older to turn part of the value of their home into usable cash, without having to sell or move out.

The Reverse Mortgage Calculator is a simple tool that helps homeowners aged 55+ understand how much equity they can access from their home. It takes in three key inputs—Home Value, Loan Amount, and Duration—and instantly generates different financial scenarios.The results are presented in a clear, straightforward format, showing how available funds and future equity may shift over time. This helps users make informed decisions with confidence and clarity.

Design Guidelines

Simplicity & Clarity

- Use plain, jargon-free language with short, supportive instructions.

- Follow a single-question flow so users focus on one step at a time, guided by clear progress indicators.

- Use clear, concise language to explain the purpose of each step and the benefits of the calculator. Apply strong visual hierarchy—highlight key numbers and CTAs, keep supporting details secondary.

Trust & Engagement

- Reinforce credibility with disclaimers, trust signals (badges, testimonials), and transparent explanations.

- Provide educational support (FAQs, tooltips, videos) to reduce doubts.

- Use micro-interactions to celebrate progress and keep the experience engaging.

Accessibility & Responsiveness

- Design with inclusivity in mind: larger text, high-contrast visuals, and WCAG-compliant interactions.

- Optimize for older audiences and ensure touch-friendly mobile responsiveness.

- Keep the design scalable for future features like comparison tools or downloadable reports

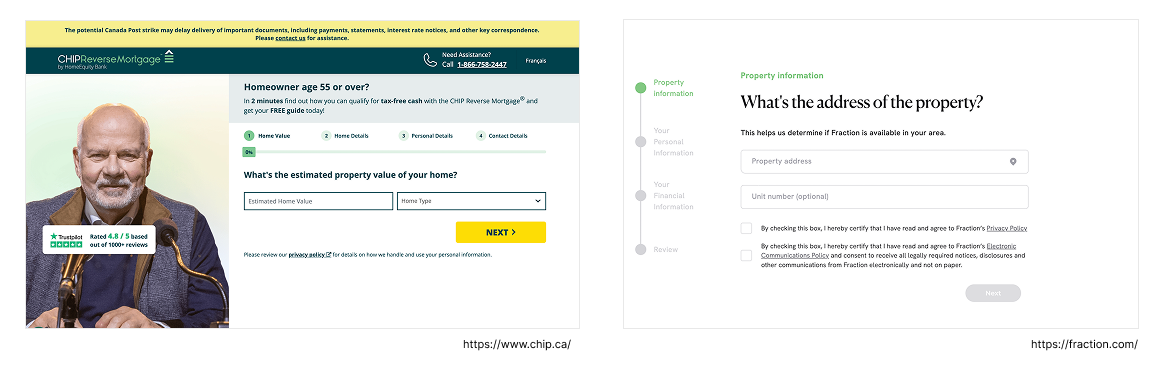

Current market

Fintech Calculators

Research

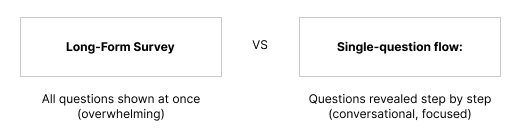

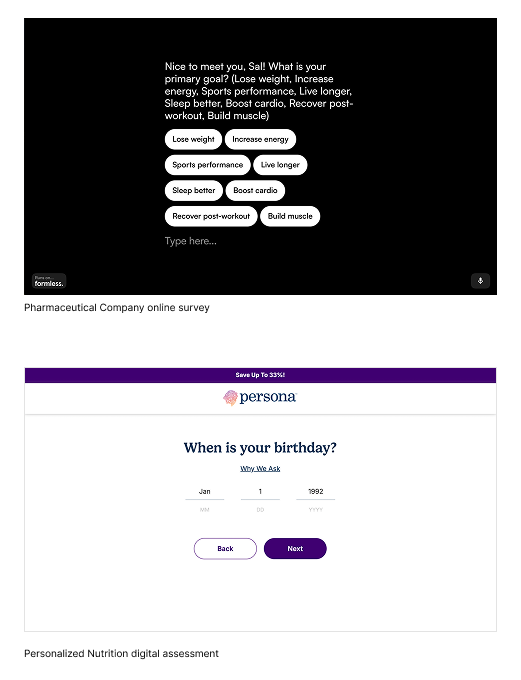

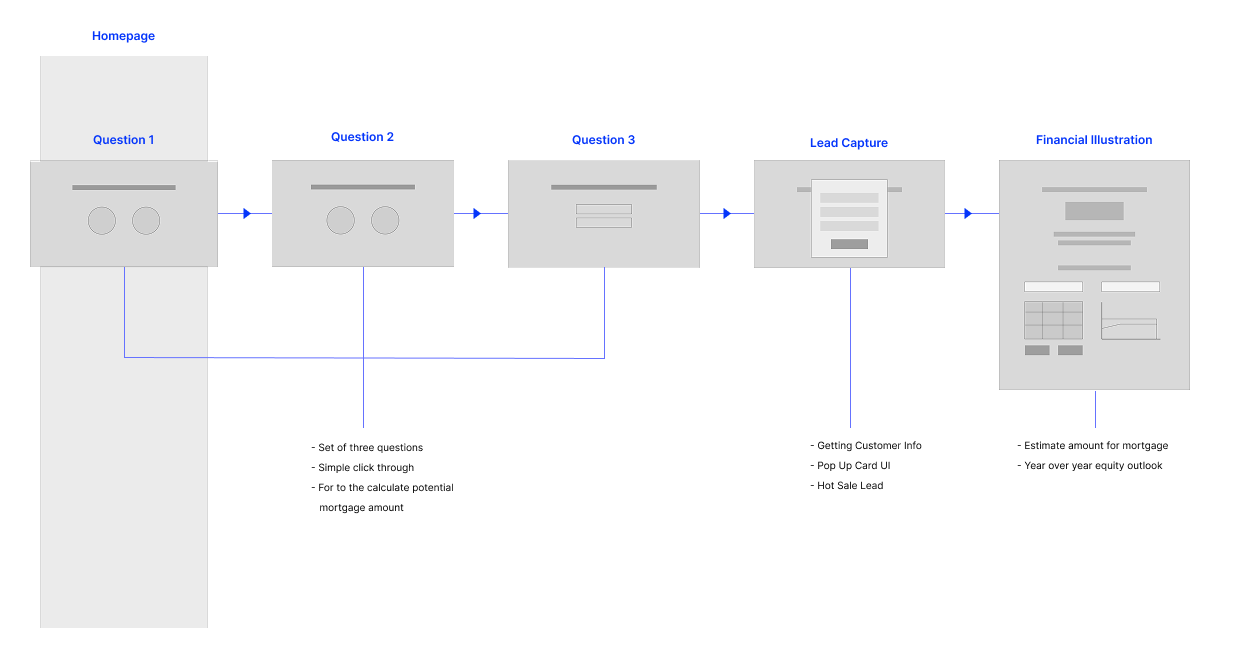

Single-Question Flow (Conversational UI)

This approach presents one question at a time, creating a lightweight, conversational experience rather than overwhelming users with a long list. By applying progressive disclosure, users stay focused, leading to higher engagement and completion rates.

When it works best

- Mobile-first design, where screen space is limited

- Complex surveys that need to feel simple and approachable

- Research requiring higher response accuracy and reduced drop-offs

Why it's effective

- Reduces cognitive load by breaking tasks into smaller steps

- Mimics natural conversation, making the experience feel human and intuitive

- Encourages thoughtful answers and improves overall data quality

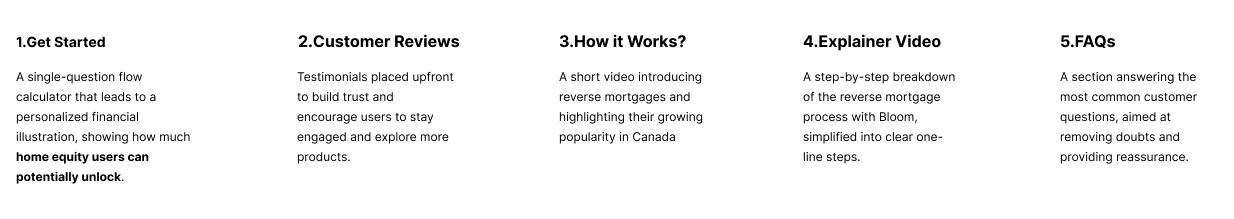

Homepage Content Guide

Key Information

Page Flow

UI Libray

Responsive Design

I designed a reverse-mortgage experience that turns a complex, emotionally loaded product into a calm, comprehensible decision journey for adults 55+. Starting with interviews and co-design sessions with homeowners, caregivers, and advisors, I mapped fears (loss of control, hidden costs) to interface patterns: plain-language copy, progressive disclosure of fees and obligations, large-type, high-contrast layouts, and WCAG-compliant interactions.

A scenario-based calculator shows “now vs. 5–10 years” outcomes, while a personalized Equity Access Plan summarizes options, risks, and next steps in one printable, advisor-ready document. Microcopy clarifies legal terms without patronizing; empty states guide, not scold.